Subscribe to my monthly newsletter here or follow me on Twitter so you don’t miss any Money Diary post!

My console table from CB2 just arrived and Eric was instantly ready to get everything to go with it (a mirror, some plants and decor). He then asked me how our spending is trending this month. I had no answer for him as I don’t normally update more often than once a month. However, given that we will probably go out this weekend to shop for the aforementioned items and with the Whistler trip coming up, I figured it won’t hurt to figure out exactly how we have been doing.

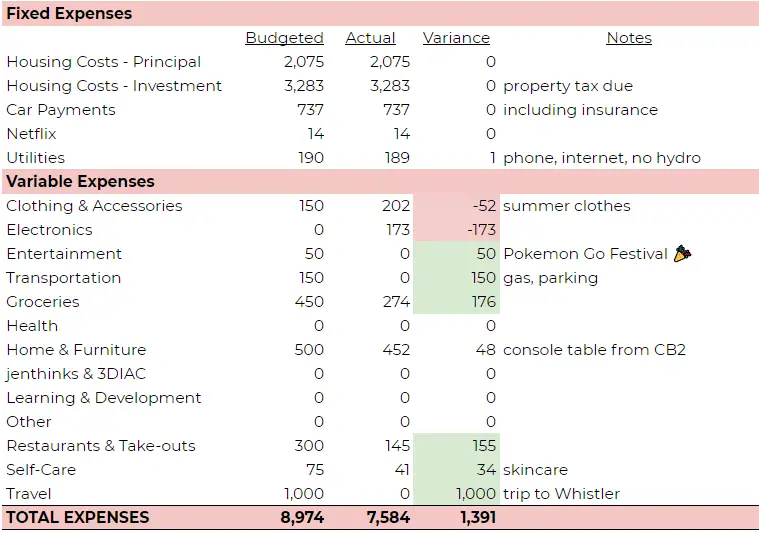

Budget for July 2020 – Mid-Month Update

So, Where Are We At?

As expected, there was no surprise with the Fixed Expenses.

Under Variable, my Aritzia trip put me over budget as expected but I still stand by my very wise decision (3 dresses for that price, COME ON). The only reason we are trending under budget for Entertainment is that the Pokemon Go Festival hasn’t taken place yet. Our trip to Whistler will require a fill-up for sure so the transportation category will either be used up or at least very close.

Since we are in the middle of the month, it makes sense that our grocery budget is trending at 50%. I still have about one week’s worth of groceries left so we might end the month under budget. For restaurants and take-outs, thanks to mostly fast-food meals by choice and the Thai food that lasted us more than 2 meals, we are at ~50% as well.

For self-care, I picked up a few drug-store items hence the lower costs. However, one (or two) of the 3 items I got is not feeling right with me so I might have to pick up a replacement. Since our Whistler trip hasn’t happened, the Travel category remains green.

So, the answer to Eric’s question is we have nothing left for Home & Furniture (combining Clothing, Electronics, Home & Furniture, Self-Care & Travel). I am keeping the food-related category separate because that is more of a necessity than entertainment. So we will probably have to make a decision on either…

– cut down on Travel expenses

– postpone shopping for more home items next month

– screw the budget and buy everything we want (depends on how beautiful the mirror is I guess)

Now I Know Where We Are At, What Will Happen?

As I have mentioned in the introduction post of this Money Diary series, one of the reasons why I am sharing my money diary is because I found it interesting when I read about other people’s financial decisions. To buy or not to buy that mirror is a financial decision. To be able to make the decision consciously allows you to be in full control of your finance which is a very big part of your life.

In my case, it is a joint decision between Eric and me. However, it will most likely ends up with me trying to convince him to postpone the purchase because I got a budget to respect 😂.