Subscribe to my monthly newsletter here or follow me on Twitter so you don’t miss any Money Diary post!

If you missed it, check out my October Budget here

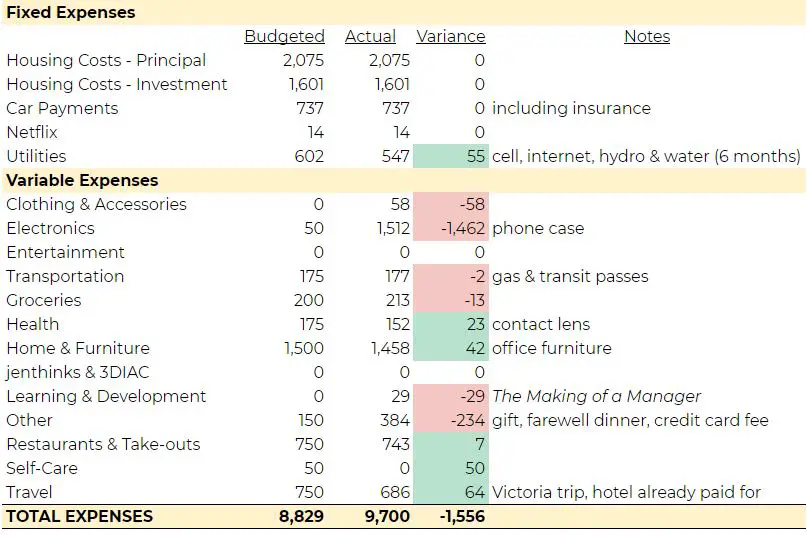

As expected when I wrote the recap, once Eric picked up a couple of items on his list, our budget will be blown away. However, I was impressed with our ability to stay on budget on our Victoria trip.

As an Amazon Associate I earn from qualifying purchases.

Budget vs. Actual for October 2020

Categories We Did Well On

Oh boy, this will be a brief section.

We have a small positive variance (underbudget) in Utilities but that is only due to the timing of our internet payment and $10 discount on our phone bill (Eric did his magic again). I will make sure I adjust next month’s Utilities budget. We picked up a couple of smaller items under Home & Furniture after I wrote the recap and ended October just under budget. For Self-Care, since I didn’t end up getting a new foundation (I simply don’t wear it often now that I work from home again), I didn’t end up using the budget at all.

As I have already mentioned in the beginning, we managed just under budget for our Victoria trip budgeted under Travel. The whole trip ended up costing us just under $1,200 CAD for 3 days (hotel was prepaid prior to the trip). I really enjoyed our stay at the iconic Fairmont Empress.

Categories We Overspent On

Eric picked up a hat from tentree (the exact one is not available anymore but here is a similar one) that looks exactly like the one he has been looking for. We found it at the cutest little store near our hotel that was playing Folklore by Taylor Swift (talk about the right shopping vibe). Since we didn’t budget for any clothing this month, we were over for Clothing & Accessories.

For Electronics, it was all thanks to Eric. He picked up two of the biggest items on his shopping list for a new computer – LG 35″ Curved UltraWide Monitor and the MSI RTX 2060 Gaming Z graphics card. The graphics card is actually on backorder right now so there is a chance he can’t get this one and have to get a newer version (translation: more $$). All I can say is, he is having a great shopping year.

For Transportation, we literally just went over budget. However, I did allocate one gas-up ($45) to Travel as I have always calculated our travel expense that way. For Food, we also barely went over budget ($6). Same with the gas-up, I allocated all the meals on our Victoria trip to Travel as we tend to spend more on food when we travel (e.g., eating 3 meals a day out). For those interested, we spent about $300 on meals for 3 days excluding breakfast as Fairmont Empress took care of them in exchange for photos and a review post. We probably would have spent a lot less if we didn’t go to a steakhouse for our anniversary dinner (btw, ambience and service were amazing but I always have trouble justifying expensive steakhouses so we probably won’t do it again anytime soon).

For Learning & Development, since Eric is starting his new job next week, he wanted to read The Making of a Manager by Julie Zhuo. We had to buy the book since he is a bit of a germaphobe (forever and always) and library books are a no-no. I have heard amazing things about this book (can confirm already as he started the book) so I thought keeping a hardcopy will be nice (otherwise we could have gotten an e-book).

Under Other, after spending a bit more than budgeted on the birthday gift earlier this month, we also had a small farewell dinner with Eric’s coworkers and he bought the first round of drinks.

Conclusion on Budget vs. Actual

October was an expensive month for us ($1,556 overbudget/$9,700 spending in total) with the trip and electronic purchases. This month was even more expensive than August when one of our property taxes and annual home insurance were due ($9,529 spending). However, we have been justifying our purchases using the following reasons:

- makes sense to furnish our offices since we now work from home full-time (and most likely continue to for the foreseeable future)

- both Eric and I started new jobs this year with a significant increase in income

- savings from all the much more expensive trips we cancelled this year (our Kamloops, Whistler & Victoria trips combined would have been less than our Asia trip if it happened in March)

However, we are by no means going crazy with our spending. Our expensive anniversary dinner still hurt the next day when the steak and lobster had been digested (I am a cheap eater🤷). I know how lucky we both were this year as we did not suffer any loss of income due to the pandemic and both found better opportunities before the year is over.

The pay increases did not and will never get over my head but I am ultimately glad we are in a better financial position than we were.