I grew up in Hong Kong. I went to school there for 9 years before moving to Vancouver. My family still lives there. Before COVID, I went back every other year (or sometimes every 3 years). It was a lot easier to stay for an extended period of time when I was in school. After I started working full-time, it became harder to visit for more than two weeks at a time. However, as some of you who follow me on Instagram know, I went back for over a month recently.

Other than the fact that it was the first time I saw my family in years, it was also the first time I went back feeling very financially secured. While my family took care of a lot of my expenses while I was there (youngest = spoiled), it felt different because I can actually afford a lot of things on my own (even the finer things I won’t actually splurge on). So, for the first time ever, I contemplated moving back to Hong Kong. You might be wondering why I had to wait until now to consider that. Well, because Hong Kong is expensive. If you want a certain standard of living, it will cost you the same or even more than many North American cities including Vancouver.

While I don’t think we will be moving back anytime soon, I did find out how much it would cost us to live in Hong Kong. Living in Hong Kong will cost us $595,476 HKD / $102,668 CAD combined per year if we don’t save or invest at all. But saving and investing are important to us so the more realistic cost is $991,882 HKD / $171,092 CAD.

While you can certainly live in Hong Kong for much less than what I am presenting here, my goal is not to sacrifice the standard of living we are happy with. Eric and I decided it will be fine to ditch driving because the public transit system is very advanced in Hong Kong. Other than that, we decided the following are a must for us:

- a new or pretty-new 2-bedroom rental that is close to public transit (ideally connected to a train station)

- able to travel several times a year (3 week-long trips or equivalent + smaller weekend getaways)

- no cooking (same as now but there will be way more dining options in Hong Kong)

- ability and flexibility to make bigger purchases here and there without stress (with a little bit of planning is fine)

- save and invest just as much as we do now (~40% take home pay)

The Expenses (Monthly Cost)

| Expense Category | HKD | CAD |

| Housing | 23,500 | 4,052 |

| Dining | 9,733 | 1,678 |

| Transportation | 1,000 | 172 |

| Insurance | 1,500 | 259 |

| Travel | 3,390 | 584 |

| Shopping/Entertainment | 9,000 | 1,552 |

| Utilities | 750 | 129 |

| Household | 750 | 129 |

| Monthly Total | 49,623 | 8,556 |

| Annual Total | 595,476 | 102,668 |

Housing ($23,500 HKD / $4,052 CAD)

We want a minimum of 2 bedrooms so one of us can work in the extra room and the other can work in the living room. This set up is what has been working for us for several years so I am not ready to change that. While I am not sure we will work remotely full-time, we will likely only consider hybrid opportunities so having the work space at home is crucial.

This listing fits all of our criteria and is asking for $23,500 HKD ($4,052 CAD) per month . It’s a 2-bedroom at 637 sq ft (believe it or not, it’s already the most spacious 2 bedroom floorplan available) in a brand new building. The unit is south-east facing on a high floor with an open-concept kitchen.

While we are not firm on the location, my research tells me that $23,500 HKD a month is a fair budget for many parts of Hong Kong.

Dining ($9,733 HKD / $1,678 CAD)

I tracked my expenses closely for weeks when I was in Hong Kong for this purpose. I wanted to know how much dining out exclusively would cost. Eric and I have dined out pretty much exclusively for years (I only cook a handful of times a year if you don’t count simple meals like oatmeal), so I have a really good idea of how much we spend on food in Vancouver (~$1,500 to $1,700 per month).

It was surprising to me that we would be spending basically the same amount on food in Hong Kong as we do back home. I really thought dining would be a lot cheaper in Hong Kong. What I failed to realize until I started tracking my expenses on this trip was that while each meal can cost less in Hong Kong, the portions are smaller. I can almost always finish my meals in Hong Kong when I almost always bring home leftovers in Vancouver.

Transportation ($1,000 HKD / $172 CAD)

This category is where we save a lot of money because we will not be driving (no car payment and insurance). By relying on public transit (including Ubers and taxis), we will be spending about 15% of what we normally spend on transportation back home. The best part? We will likely get to places faster by relying on trains and subways over driving too.

Insurance ($1,500 HKD / $259 CAD)

The public medical system works a bit different in Hong Kong – while it is not as expensive as it is in the US, seeing a family doctor certainly isn’t free. A quick Google search tells me that a family doctor’s visit will run from $200 to $400 HKD which includes medication (cheaper if you go to public hospitals). Since both Eric and I are in pretty good health, I decided not to put too much effort in figuring out different scenarios (e.g., cost for 3 visits to the doctor each year). I looked around for a health insurance plan and rounded out the numbers to get to the $1,500 HKD per month.

Note, Hong Kong offers both public (cheaper) and private healthcare so costs can vary wildly depending on which route you choose.

Travel ($3,390 HKD / $584 CAD)

Before COVID, Eric and I took three to four trips every year. Most of them were less than a week long. Obviously that stopped when COVID hit. Now that the world is essentially back to normal (albeit much higher prices), we intend to travel as much as we can again. There are many cities that are only several hours plane ride away from Hong Kong so I expect most of our travels would include those destinations (e.g., Japan, Taiwan, Thailand). On top of that, I would love to explore Mainland China.

Since our dining budget is inclusive of travel days (I budgeted for 365 days), I only include flight and hotel costs in this category. I ran the numbers for 5-day-4-night trips to Tokyo, Bangkok and Taipei. The average flight and hotel cost per trip is $11,300 HKD / $1,950 CAD. Then, I added a 20% buffer ($6,780 HKD / $1,169 CAD) to account for smaller weekend trips.

Shopping/Entertainment ($9,000 HKD / $1,552 CAD)

Hong Kong is often referred to as the “Shopping Paradise” and is known as the “city of malls.” There are so many options for any budget – from a $5 basic t-shirt to $900 branded one. The best part? There are thousands of choices in between.

I don’t expect us to spend $9,000 HKD / $1,552 CAD every month shopping or on entertainment but I am pretty sure we will spend that amount on average. While I did budget for rent, travel, utilities, insurance, household items separately, I did not budget for big ticket items like electronics and furniture separately. This category covers shopping and entertainment costs during our travels as well.

Utilities ($750 HKD / $129 CAD)

This category is for phone bills and electricity. I didn’t put that much effort into this as it is a relatively inexpensive category. Since phone plans in Hong Kong are a lot cheaper than Vancouver, I expect the actual costs to be pretty close to my estimate here.

Household ($750 HKD / $129 CAD)

This category includes necessities like toilet paper, cleaning supplies, towels etc. I probably over-budgeted for this specific category month-to-month but I prefer to be conservative.

It Costs $991,882 HKD / $171,092 CAD to Live The Way We Want In Hong Kong While Saving & Investing 40% of Take-Home Pay

One criteria that is very important to us is that we will save and invest just as much as we do now regardless of wherever we call ‘home.’ This is my way of making sure we NEVER spend more than we make. While we only have to make enough to cover expenses for that to be true (i.e., take home $102,668 CAD annually), I also want to take care of the future. Our long-term financial plan is not something I would give up on for short-term enjoyment.

So, with a target of saving and investing 40% of our take-home, I calculated the take-home pay required to live in Hong Kong:

| Category | HKD | CAD |

| Annual Expense (60%) | 595,476 | 102,668 |

| Saving / Investment (40%) | 396,406 | 68,423 |

| Total Take-Home Required Combined | 991,882 | 171,092 |

How Much Do You Need to Make to Take Home $991,882 HKD / $171,092 CAD in Hong Kong?

To make it simple, I did the math assuming:

- Eric and I make the same amount of money, and

- Employment income is our only source of income

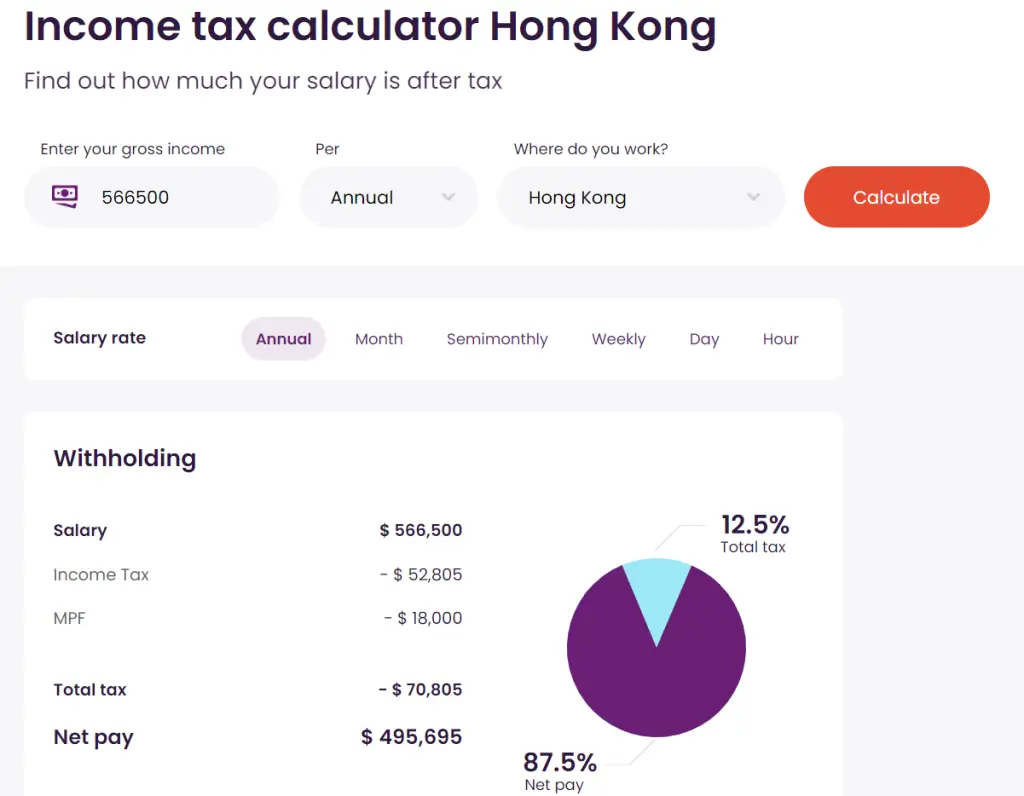

Using this calculator, I concluded that an annual gross income of $566,500 HKD / $97,672 CAD per person would satisfy our criteria. This translates to monthly gross income of $41,308 HKD / $7,122 CAD per person. Based on a quick search on LinkedIn, there seem to be a number of hybrid mid-level to senior-level accounting jobs fitting that criteria.

But What If We Don’t Save or Invest At All – How Much Do We Need to Make to Live In Hong Kong The Way We Want Then?

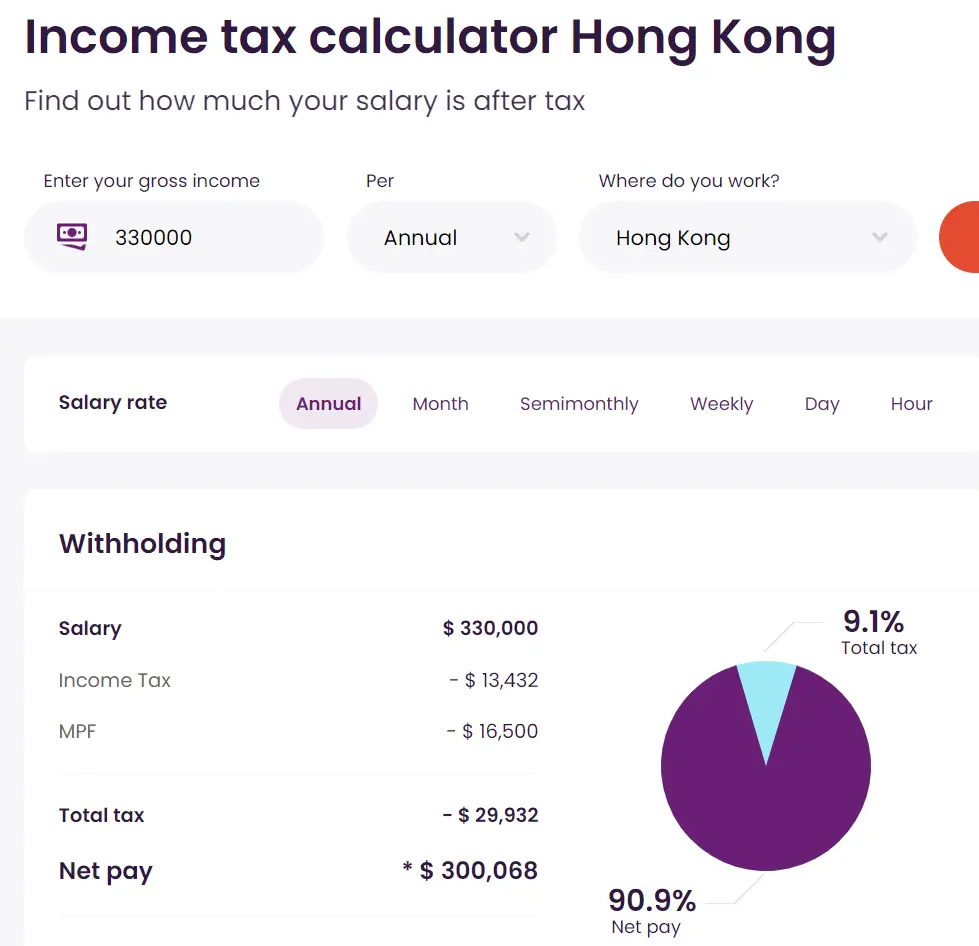

To just cover our combined annual expense of $595,476 HKD / $102,668 CAD, we need to bring home $297,738 HKD / $51,334 CAD per person. This translates to annual gross income of $330,000 HKD / $56,896 CAD or monthly gross income of $27,500 HKD / $4,741 CAD per person.

For accountants like myself, this is a very achievable compensation. Of course there are always jobs out there paying much less than market. However, the same is true everywhere you go. Remember, top talent demands top compensation.