Join me on Instagram and subscribe to my newsletter so you don’t miss any Personal Finance post!

As I am typing this, I have been working from home for 2 weeks and left the house for groceries once. Other than that, I went for a walk last weekend but have mostly been stretching at home.

We are lucky we have space we can designate as a work area so we don’t feel like we are working all day (which can be the case if you can’t “leave” your working station). We also have a small balcony if we want fresh air even though there is no furniture there.

Like many others, in addition to worrying about the virus itself, I have also been worried about recession, job security and basically what the future holds.

Eric’s and my office jobs have been unaffected so far but I have taken some actions to give myself reassurances that if things change for the worse, we will be mentally and financially prepared. Note, these are mostly things I have been doing regularly (so should you) but changing the frequency or performing them with a new mindset is key. I hope this will be helpful to you.

1. Find Out or Update Your Net Worth

I believe that financial independence begins with knowing where you stand today. The term ‘net worth’ might sound intimidating to some because it’s not something you talk to your family and friends about on a daily basis. However, net worth is a common term used in the media (e.g., when you want to find out how much a celebrity is worth, you google the net worth of the celebrity) and if you care about the net worth of a celebrity, you should definitely care about your own.

Calculating your net worth is simpler than you expect.

Everything You Own – Everything You Owe = Net Worth

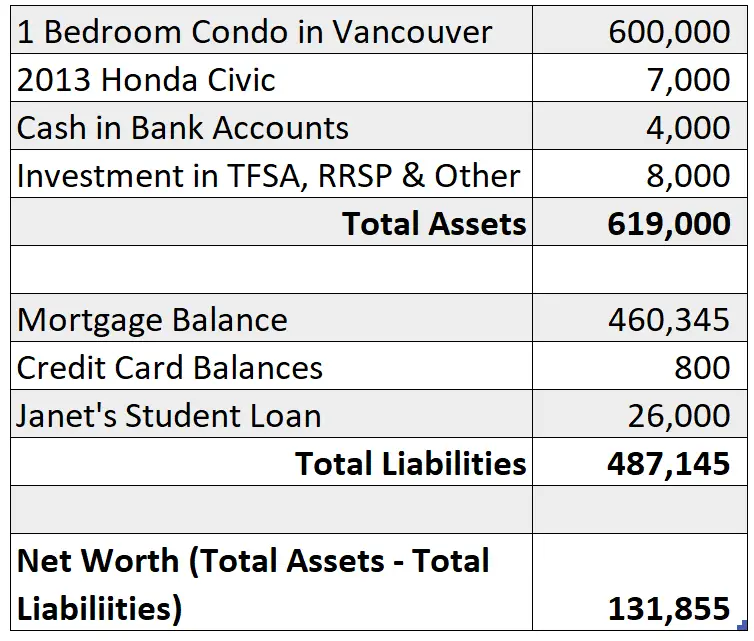

Using Bob as an example, a homeowner living in Vancouver with his wife Janet. Their net worth would be calculated as follow:

In the example, Bob and Janet have a positive net worth meaning they own more than they owe. However, keep in mind that both the condo and the car are not considered liquid (cash is the most liquid asset available, with very few exceptions), which means they can’t be turned into cash immediately. When you have upcoming bills to pay, non-liquid assets are not very useful.

Net worth is basically a company’s balance sheet: what you have left for the shareholders after paying off all of the debts. On a personal level, net worth is what you are left with after paying off all that you owe.

Finding out your net worth is always important. It is even more so now that we are going through a challenging time so we need to be prepared for job loss and market crash.

RECOMMENDED POST – Why I Chose The Amex Cobalt Card

2. Find Out Your Monthly Income & Expenses

I don’t mean to track your spending to the pennies but to have a pretty good idea of how much money comes in and out every month. In the accounting world, this would be a company’s income statement.

For those of us who are on a fixed salary, simply record the amounts that get deposited into our bank account every paycheck (after-tax because that is what you will have to pay the bills). For those of you who are on an inconsistent income, I suggest finding out the average for the past 6 to 12 months and use your own judgement to determine whether the average amount is what you would still expect for the next 6 months.

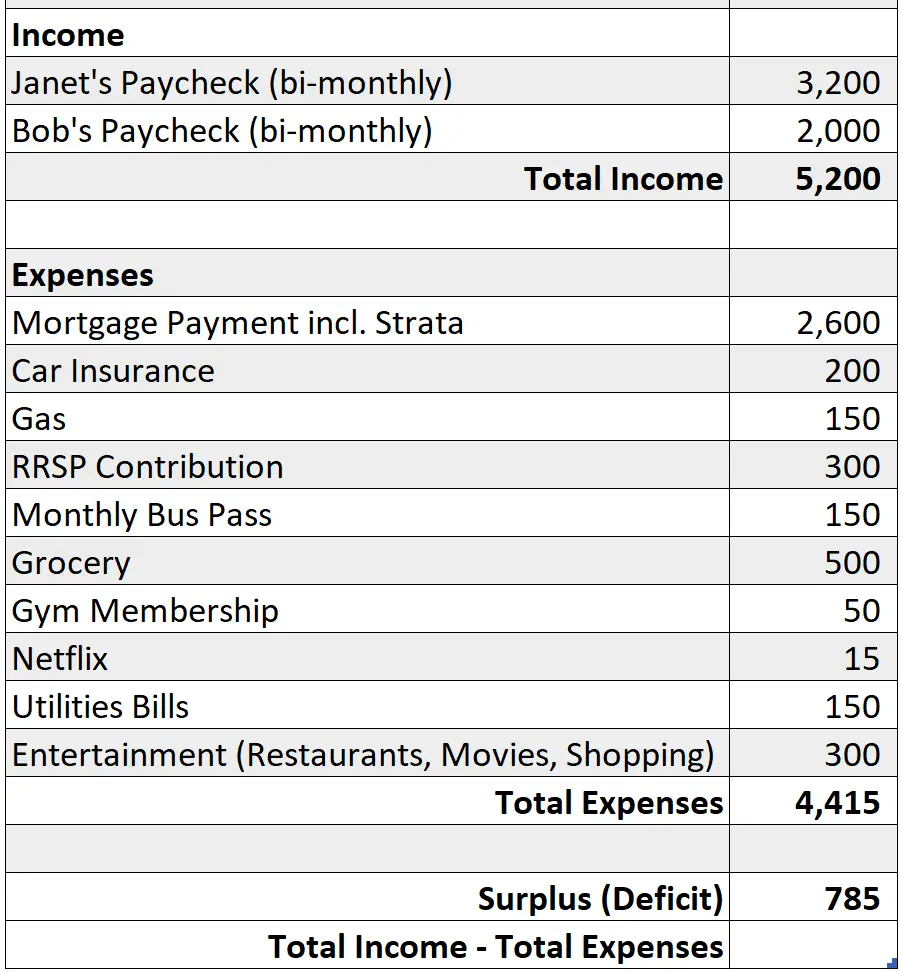

Using Bob and Janet again as an example, their “income statement” would be:

Bob and Janet are actually in good financial health because not only do they have a positive net worth, their income exceeds their expenses ($5,200- 4,415 = a surplus of $785) even after their RRSP contribution. This means, if their recorded expenses are accurate, they would have been able to save up the surplus every month.

Now that we have an idea of our “net worth” and a snapshot of our “income statement,” we can move on to really getting prepared for whatever life throws at us!

3. Bring the Numbers to the Test – Scenario Time

Job security is never a guarantee (despite what you might believe because the company seems to be in strong financial health or your boss seems to like you) but it is even less so during a recession.

Knowing where we stand financially can help us prepare for the worst. For many of us, the worst-case scenario would be losing our jobs / getting our hours reduced or getting sick which might impact our ability to work. The Canadian government has been announcing many packages that are targeted to help the ones that are impacted the most by Covid-19 but they will take time. From what I have read so far, the government subsidies will not fully cover the regular income of many households, thus, we must prepare on our own.

Continuing with Bob and Janet’s example, let’s see what happens if one or both of them lose(s) their jobs:

As you can see, even though I had mentioned that Bob and Janet seemed to be in good financial health (positive net worth, income > expense), their monthly income statement immediately goes into a deficit position if either of them loses their jobs.

This is why we must be more prepared than ever now.

Once you have completed all 3 steps mentioned in this post, you are ready to take action by making changes to your financial life. The goal is to minimize the need to tap into your savings so you can weather whatever storm that is about to come.

Continue reading Part 2 here.