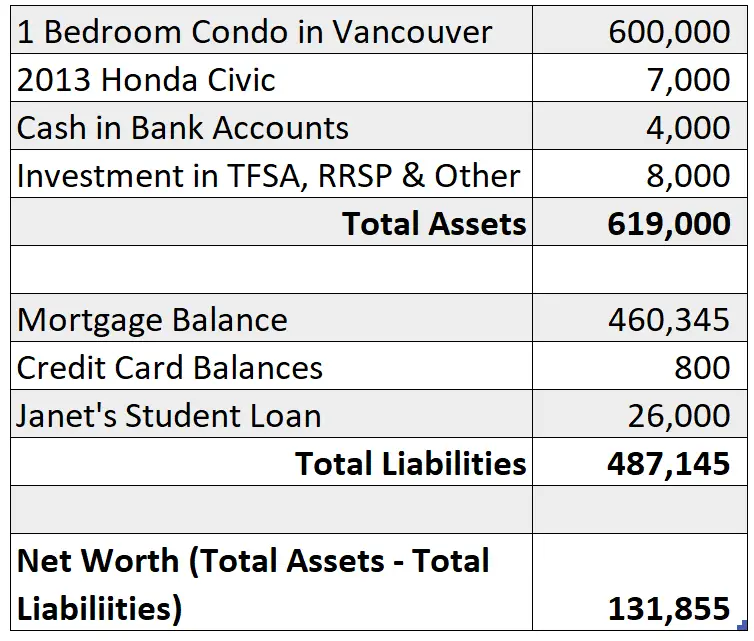

In Part 1, I talk about how to calculate your net worth, find out exactly how much money comes and goes every month and visualize what will happen if a job loss occurs in your household.

In Part 2, I will walk you through the steps you can take to recession-proof yourself so that when the worst happens, you are in a position to defend yourself financially and mentally.

Step 1 – Identify Non-Essential Expenses

Study and review the income statement you prepared in Part 1 and identify expenses that are non-essential. I prefer to think of non-essential as something that I only want, not need. For example, I can live without my Netflix subscription but I choose not to because it is a form of great entertainment. My Netflix subscription is something that I want but not need. On the other end, grocery is something that I need (also want) to survive so I consider it as essential.

Once you have identified all your non-essential expenses, the next step is to figure out how to discontinue the service (e.g., Netflix, cable TV, gym memberships) and whether there is a penalty to do so. By no means do you have to cancel the services as soon as you have identified them but the key is to know how to should the need arises (e.g., job loss).

Often times, people signed up for a fixed-term contract for services like cable tv so it is important to be aware of what the cancellation clause is. For example, if your 2-year tv contract is due to expire in the next 3 months, you might want to consider negotiating a good rate for month-to-month so you have the freedom to cancel as you wish.

Step 2 – Identify Work-Related Expenses

Another type of expenses you should identify are expenses that you will not incur when you are not working. Your monthly transit passes or car share memberships are common examples as you will not be commuting to the office anymore. In British Columbia, car insurance also costs more for driving to and from work than when you are driving leisurely. Being aware of this type of expenses will enable you to cut your expenses quickly when you are faced with a job loss.

RECOMMENDED POST – Why I Chose The Amex Cobalt Card

Step 3 – Identify Expenses You Can Negotiate

I almost never pay full price for anything even though I am not an expert in negotiation. However, it is true when you hear people say it never hurts to ask.

For example, when I moved into our condo, I had a choice between 2 internet providers. What I did was I called the one I wanted to go with as its infrastructure has already been set up in our new building and found out what their pricing was. I did not negotiate then but simply asked for the best rate. I then called their competitor and told them what the first provider offered and asked if they had anything better. I made a note of their offer and went back to the first provider. I told the agent what I did and what I was offered and basically asked them if they can beat it. They did and the process did not take long as the agent understood that I was interested in the best offer and was also in need of internet!

You can do the same with your cell phone bill, cable tv bill and home insurance. I would not suggest spending hours and hours on shopping for the best deal unless it is a very large purchase but doing what I did took less than an hour and your savings could be substantial.

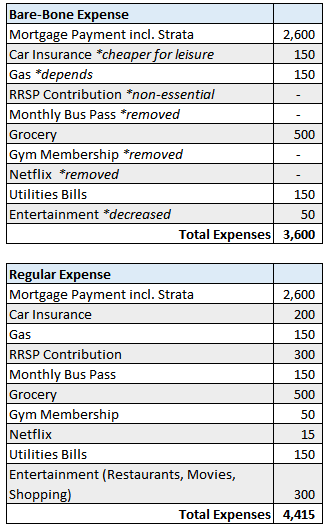

Step 4 – Calculate Your Bare-Bone Cost of Living

Now that you have identified your non-essential and work-related expenses and maybe even negotiate better prices for some of your services, you are ready to find out exactly how much you will need to survive.

Go back to your income statement from Part 1 and remove all the identified expenses from the previous steps.

Let’s continue using Bob & Janet from Part 1 as an example.

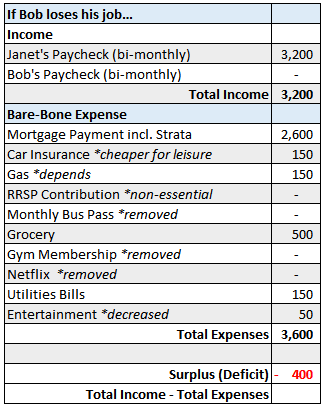

If Bob loses his job, their bare-bone expense would be $815 less per month ($4,415 – 3,600). While the savings by removing non-essential expenses are not enough to compensate for the loss of Bob’s income, it definitely helps stretch their savings longer.

Step 5 – Identify How Many Months You Can Live On Your Savings

We are often reminded of the importance of emergency savings by family, friends and the media and they are absolutely right. The most common recommendation is to have 3 to 6 months of living expenses in an accessible account (e.g., checking account, high-interest savings account). If you haven’t started putting money aside for this purpose, START. If you have, your next step would be to find out exactly how many months you can live on your savings.

Returning to our example, with only Janet’s income, Bob and Janet will be in a monthly deficit of $400. This means they will deflate their savings by $400 per month.

If you recall from Part 1, Bob and Janet have a positive net worth with cash and investment in various registered saving accounts. This means that even though the situation is not ideal, they will still be able to pay their bills with one income for an extended period of time.

I am a strong advocate of achieving financial independence through awareness of your financial well-being. This 2-part series aims to teach you about your financial situation and spending patterns so you will be able to equip yourself against situations you have no control over like a recession and job loss.

Leave a comment below and tell me what you found out about yourself – are you surprised? We can only improve through learning and personal finance is something we should never stop learning about.