The other day, someone reached out and asked me how to start investing in Canada. She is in her late 20s and just started her first full-time job. Her main goal? To be financially independent. Whenever I get a question like this, my first thought is always this: kudos to taking the first step! I have had numerous conversations with family and friends on this topic and while I am no expert in this, I am confident I know enough to offer some pointers to someone who wants to start their financial independence journey.

So, if you are looking to start investing as a beginner in Canada, this is the post for you. Before we start, I want to remind you two very important principles:

- Don’t focus on chasing the quick, big wins. There are a lot of success stories out there where people made hundreds of dollar in a short period of time. However, there are also a lot of stories where people lost hundreds of dollars seemingly overnight. This is not how you should start. How you should start is start small and focus on setting up a system that works for you.

- There is a famous saying: time in the market beats timing in the market. One thing that stops a lot of people from ever starting their investment journey is not knowing when is the right time. However, many seasoned investors would argue that evidence has shown getting started as early as possible produce better financial results than trying to enter the market at the perfect time.

- what this translates to is basically this: the best time to start investing is yesterday; and the second best time is now.

Jump to the Step-by-Step guide if you want to get started now.

Disclaimer: The content in this post is provided for informational purposes only. It is not intended to be relied on as financial or tax advice. You should consult with your own financial or tax advisor.

Tax-Advantaged Accounts for Canadians

Common Misconceptions About TFSA/RRSP/FHSA

- You can only hold savings account in them – WRONG

- investment you are allowed to hold: cash (savings accounts), mutual funds, stocks listed on a designated stock exchange (e.g., TSX), GIC (guaranteed investment certificates), bonds etc.

- source: CRA

- investment you are allowed to hold: cash (savings accounts), mutual funds, stocks listed on a designated stock exchange (e.g., TSX), GIC (guaranteed investment certificates), bonds etc.

- Everyone’s contribution room is the same – WRONG

- the contribution room rules vary between the tax-advantaged accounts (e.g., RRSP’s annual contribution room is based on your previous year’s earned income)

- source: CRA

- the contribution room rules vary between the tax-advantaged accounts (e.g., RRSP’s annual contribution room is based on your previous year’s earned income)

- One type of account (e.g., TFSA) is more superior than the others – WRONG

- every tax-advantaged account currently available to Canadians has its pros and cons. The key is to understand your own financial situations, short- and long-term goals so you can make an informed decision.

What Is TFSA (Tax Free Savings Account) & My TFSA Contribution Room?

Basic Information About TFSA

- introduction year: 2009

- tax advantage: income (e.g., interest income, dividends and/or capital gains) you make on your qualified investments in a TFSA account is tax-free

- contribution type: after-tax income (i.e., your take-home pay after-tax)

- contribution room:

- if you are absolutely certain you have never contributed to a TFSA account, use this TFSA contribution room calculator

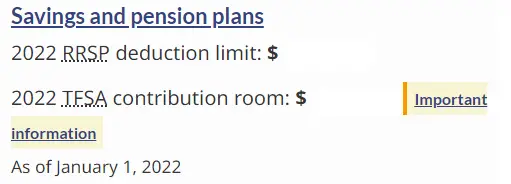

- if you are not 100% certain whether or not you have contributed to a TFSA account since 2009, log in to your My CRA account and navigate to the Savings and pension plans section (see picture below). It will tell you the TFSA contribution room you have as of January 1 of the current year.

- NOTE: if you have made any contribution to any of your TFSA accounts since Janruary 1, you have to adjust your contribution room accordingly. For example, if your My CRA account says you have $50,000 contribution room as of Janruary 1, 2022 and you made two contributions totaled $5,000 since, your remaining contribution room for the rest of the year is $45,000 ($50,000 – $5,000). Any withdrawal you made DO NOT add back the contribution room in the current year.

- there is a penalty to over-contribution so it is crucial that you keep track of your contribution room carefully

- who can open: resident of Canada who has a valid SIN and who is 18 years of age or older

What Is RRSP (Registered Retirement Savings Plan) & My RRSP Contribution Room?

Basic Information

- introduction year: 1957

- tax advantage: the ability to contribute using your before-tax income means the amount you are investing is higher and the taxes you owed on your income are deferred until withdrawal

- you must either close your RRSP accounts, purchase an annuity or convert it to a RRIF (registered retirement income funds) by the end of the year you turn 71

- there are two special programs that allow you to make early RRSP withdrawals that are not subject to the withholding tax (ranging from 10% to 30% in all provinces except for Quebec):

- Lifelong Learning Plan (LLP) for RRSP holders or their spouses to go back to school full-time

- Home Buyers’ Plan (HBP) for qualified first-time homebuyers

- contribution type: before-tax income (i.e., your gross pay before income tax is deducted)

- contribution room:

- the formula for your RRSP contribution room is this: 18% of your previous year’s earned income

- however, you can check your available RRSP contrituion room by logging into My CRA Account and navigate to the Savings and pension plans section (see picture above)

- NOTE: if you have made any contribution to any of your RRSP accounts since Janruary 1, you have to adjust your contribution room accordingly. For example, if your My CRA account says you have $50,000 contribution room as of Janruary 1, 2022 and you made two contributions totaled $5,000 since, your remaining contribution room for the rest of the year is $45,000 ($50,000 – $5,000).

- there is a penalty to over-contribution so it is crucial that you keep track of your contribution room carefully

- who can open: Canadians who has employment income and file tax return

What Is FHSA (Tax-Free First Home Savings Account) & My FHSA Contribution Room?

Basic Information

- introduction year: sometime in 2023 (FHSA was announced in Aug 2022)

- tax advantage: the ability to contribute using your before-tax income means the amount you are investing is higher and if you are withdrawing the money to purchase your first home, the withdrawal is tax-free

- combination of RRSP & TFSA

- contribution type: before-tax income (i.e., your gross pay before income tax is deducted)

- same as RRSP

- contribution room:

- unlike RRSP and TFSA, the contribution room formula for FHSA is a lot more strightforward

- the annual contribution room is $8,000 after an individual opens an FHSA for the first time. The lifetime contribution limit, regardless of when you turn 18 or your earned income, is $40,000.

- who can open: resident of Canada that is at least 18 years of age and must be a qualifying first-time home buyer

I Am Starting Small – Which Tax-Advantaged Account (TFSA, RRSP or FHSA) Should I Contribute To First?

Before I proceed with my recommendations, I want to highlight that your opinions might vary and I respect that completely. My intention with these recommendations is to make it as easy as possible for beginners to start investing today. When you are starting small (e.g., as little as $100 per paycheck), you can afford to trial and error (e.g., largely harmless error such as contributing to TFSA first before RRSP, and not error like over-contributing to your TFSA) and adjust your plan as you go. The key is to get into the habit of saving and investing ASAP.

When You Should Contribute to TFSA First

If you are just starting your career making entry-level wage for your field, chances are the following are true:

- your income tax bracket is lowest than it will ever be

- you don’t have a lot of money to contribute and for simplicity, you prefer to focus on one account to start

Furthermore, if you also don’t meet the criteria for qualifying tax-free withdrawals under the new FHSA program, I recommend starting with TFSA. The tax-savings on your RRSP contribution will be relatively minimal compared to when your income tax bracket is higher as you progress in your career. In addition, because your RRSP contribution room is calculated based on your previous year’s earned income, chances are you barely have any room to contribute to. If this year is your first working year, you will have no RRSP contribution room at all.

Also, if you intend to withdraw from your TFSA in the next several years for various purposes (e.g., a renovation, a big trip, a non-first-time home purchase), TFSA is a better option than RRSP as early RRSP withdrawals are subject to withholding tax (ranging from 10% to 30% in all provinces except for Quebec) In addition, the withdrawal will be added to your taxable income that year.

When You Should Contribute to RRSP First

If one or both of the following applies, I recommend contributing to RRSP first:

- your main goals are to save for retirement and/or purchase your first home or go back to school full-time

- your company offers RRSP match (e.g., up to 5% match meaning if you contribute 5% of your gross income, your company contributes another 5% on your behalf)

If point #1 is true, the tax consequences associated with withdrawals are more favorable (e.g., qualified withdrawal under the HBP is not subject to withholding tax like unqualified, early withdrawals). Also, despite not making much in your initial working years, any tax saved will still be beneficial to growing your investment. Furthermore, if your company offers RRSP match (point #2), that is basically free money you should not say no to.

When You Should Contribute to FHSA First

The benefits of the FHSA will be maximized for qualified first-time homebuyers. If purchasing your first home in Canada is your main financial goal within the next 15 years (as you are required to close your FHSA account after 15 years), I suggest contributing to FHSA first. Since it allows you to contribute pre-tax income, there is more money to invest and grow. Then, when you withdraw the money to purchase your qualified first home, the income you make on your investment under FHSA is not taxable.

What if your situation or plan changes so you will not be making a qualifying first-home purchase withdrawal anymore? The good news is you can transfer your fund in your FHSA to RRSP penalty-free. This also makes FHSA more attractive to people who do not currently have any or very minimal RRSP contribution room as the FHSA contribution room is not dependent on income.

What About Contributing to a Combination of TFSA, RRSP & FHSA?

Assuming you meet the criteria to take advantage of all these tax-advantaged accounts, there is no strong reason why you shouldn’t contribute to all of them. However, I want to urge against doing too much when you first start investing. Simplicity is key to building consistency and keeping it up for a long time. Remember the second principle? Time in the market beats timing in the market. You want to be doing this for as long as you can by starting small and now.

Step-By-Step to Investing in ETFs Cheaply & Easily With Questrade or Wealthsimple

Disclaimer: The following sections contain referral links. If you use these links to open an account, I may earn a referral bonus.

First, Questrade or Wealthsimple?

I have tried several trading platforms in the past (e.g., Questrade, BMO Investorline) and found Questrade to fit my current needs the best. However, one popular alternative to Questrade is Wealthsimple. I am going to give you an overview of why I chose Questrade over Wealthsimple as reference. However, both products would work fine to start.

Since I buy ETFs regularly by following the cost-averaging method, free ETF purchase is the key feature I am looking for. While both Questrade and Wealthsimple offer free ETF purchase, Wealthsimple wins in this regard if you sell ETF regularly as selling is also free with Wealthsimple. In fact, all trades are free on Wealthsimple. With Questrade, commissions are charged on all trades except for ETF purchase.

So why do I favor Questrade over Wealthsimple? This is because even though I can buy US stocks on both platforms, I can’t hold USD in a Wealthsimple account. This means every time I trade (buy or sell) a US stock or US ETF, I have to pay 1.5% currency conversion fee from CAD > USD and vice versa. With Questrade, since I can hold USD in my account (e.g., TFSA), I only have to pay the exchange fee (~1.45%) once to convert it from CAD to USD to start trading US stocks or US ETF. Even if I sell the stock later, I can keep the cash in USD instead of converting it back to CAD like Wealthsimple would require me to do (and get charged the currency conversion fee again).

The bottom-line is, if you follow my plan in the next section, either Questrade or Wealthsimple will work just fine. This is because you are expected to buy regularly but not sell regularly, meaning most of your trades on either platform will be free.

Step-by-Step to Investing as a Beginner in Canada

- Get a solid and objective understanding of your current finances by finding out the following:

- monthly income & expense

- net worth

- if you need help with these two calculations, check out my post here

- if you need help with these two calculations, check out my post here

- Based on what you find out from Step #1, answer the following questions:

- How much can you put away to start? this will be the amount of cash you will use to fund your account in Step #3, excluding emergency fund sitting in your savings/checking account (most common suggestion say 3- to 6-months of living expenses but it is entirely up to you; you can also start investing and saving up for emergency fund at the same time)

- How much can you put away each paycheck? I want you to keep in mind that you are going to pay yourself first by taking care of your future while maintaining a reasonable standard of living

- remember, $100 per paycheck is as valid a start as $1,000 per paycheck. you can always increase it gradually.

- remember, $100 per paycheck is as valid a start as $1,000 per paycheck. you can always increase it gradually.

- Open a free Questrade or Wealthsimple account and fund the account(s) via direct deposit

- minimum funding amount: Wealthsimple: $0; Questrade: $1,000

- TFSA, RRSP or both

- FHSA is not available as of the writing of this post but it is expected to roll out sometime in 2023

- Set up regular pre-authorized debit to fund your investment account every time you get paid

- the amount should be the answer to the second question from Step #2

- this way, the money will come out of your account automatically leaving you no chance to spend it on something discretionary

- Set a calendar reminder every month (e.g., last day of the month) to login to your Questrade or Wealthsimple account and buy the same ETF in one trade

- this should take you no more than 10 minutes a month and this strategy follows the cost-average method

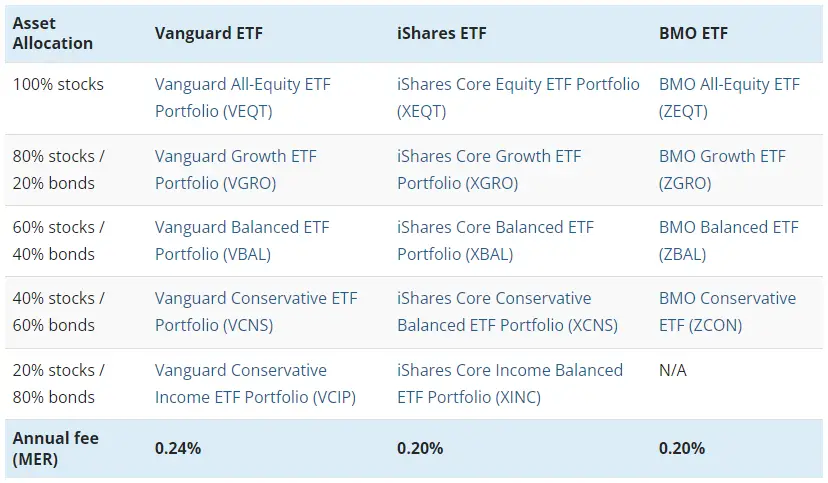

- their list below is sorted by highest risk (100% stocks) to lowest risk (20% stocks/80% bonds); depending on your comfort-level, pick one ETF from Vanguard, iShares and BMO

- for example, if you want to start safe with a bit of room for risks, you can go with the 60% stocks/40% bonds split (ticket: VBAL, XBAL or ZBAL)

- if you need guidance on how to choose asset allocation, check out this video

- because my intention is to make this process as simple as possible for you who is just starting, instead of getting you to purchase a list of ETFs, I urge you to follow the famous Canadian Couch Potato Model Portfolio

- the ETFs on their list “include Canadian stocks, US stocks, and international stocks (from both developed and emerging counties), giving you broad exposure to the global equity market.” In other words, they are diversified.

LAST BUT IMPORTANT STEP. Set a calendar reminder 6 months since the day of your first trade.

- I want you to take some time to review what worked and what didn’t’ work in the past 6 months. This allows you to take more control over your personal finance instead of relying on someone on the internet’s advice. What works for me or your friend or your colleague or your bank advisor does not mean it will work for you. Ultimately, you are responsible for your financial future.

- This is also a good checkpoint for you to adjust your regular contribution

- can you put away more each paycheck? if so, update your pre-authorized debit

- did you get a raise? if so, consider putting all or some of the increase towards savings or investing

- As you get more comfortable with the whole concept of investing, you can adjust your plan based on your risk tolerance, short- and long-term financial goals. You have already taken arguably one of the most difficult steps: starting. Even with the market’s up and down, you are likely to come out ahead with consistency and time on your side.

Before I end this post, consider these scenarios:

- if you start with $1,000 at age 30 and invest $500 per month with an average annual return of 5%, you will end up with $412,010 when you turn 60.

- what if you contributed $750 per month instead of $500? $615,854.

- what if your average annual return is 8% instead of 5%? $714,338.

- how does being a millionaire sound? well, join the club at 8% return with $750 per month.