Now that I found my next dream home, I am motivated to review my net worth and investment strategy carefully again. I have been toying with the idea of hiring a fee-only financial planner later this year but until then, I will continue to rely on my own + internet + network as I have always done.

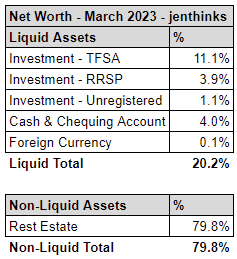

Net Worth Analysis

Even though I also manage Eric’s finances, I decided to only share my own figures on jenthinks. For assets where I am a co-owner, my net worth analysis represents my ownership.

Liquid Assets

I have not filled my TFSA back up ever since I made a couple of withdrawals for an investment last year. That would be on the top of my list to do this year especially with the market being down still (buy low!).

Also, I have more cash sitting in my chequing this month (4%) but that is temporary. I had to set aside some money for a couple of larger bills and our upcoming Asia trip this month.

Non-Liquid Assets

If someone takes one look at my net worth, they will probably tell me to stop investing in real estate. And that person is probably right. My current net worth is too heavily invested in the housing market (80%). However, the value includes my principle residence and two* investment properties. While they are all located in BC, they are not located in the same city which should help lower conentration risk.

Last week, Eric and I had a discussion about buying another investment property in the near future. I looked around and was surprised to realize the presale market was not as slow as I originally thought. However, after reviewing my net worth allocation, I think it is safe to say the plan is a no-go for now.

*one of them is closing next year but for calculation purposes, I included the total deposit paid

Investment Portfolio Analysis

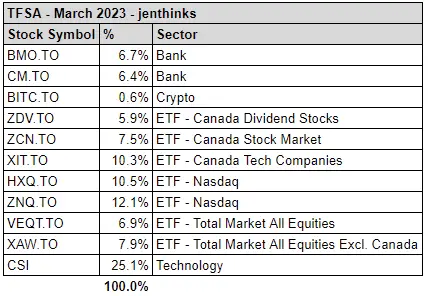

Questrade TFSA

The Bitcoin ETF (BITC.TO) is my one and only investment in crypto. I mainly keep it there to remind myself of the mistake. The good news is, it represents such a small % of my portfolio (0.6%) so I accepted it as a relatively cheap lesson learned (i.e., don’t invest in something I don’t understand blindly).

There are several things that jump out to me immediately about my TFSA portfolio:

- It can benefit from some consolidating (e.g., HXQ/ZNQ are virtually the same) but this was expected as I have not sold any stock since I made those withdrawals last year

- I am heavily invested in CSI but that is due to already owning the stocks on my own prior to participating in my company’s plan

- I am heavily invested in the Canadian stock market – 2 major Canadian banks, 3 Canadian-based ETFs and 1 Total Market ETF including Canada

While I do want to simplify my portfolio, my main goal this year for my TFSA would be the following:

- Replenish my TFSA to use up my available contribution room (+$6,500 contribution room for 2023)

- Purchase the following stocks:

- more XAW.TO for total market exposure including emerging but excluding Canada (since I already hold other Canadian-based ETFs)

- add the following dividend-paying stocks:

- Telus (T.TO)

- Fortis Inc. (FTS.TO)

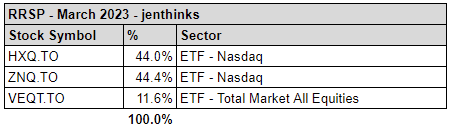

Questrade RRSP

My RRSP portfolio is relatively small compared to my TFSA. For the last couple of years, I have been making monthly contribution to my Questrade RRSP account. My job does not offer RRSP match so technically, I will not be missing out on any “free” money even if I did not. Nonetheless, after replenishing my TFSA, I will top up my RRSP next.

For my RRSP, I have been buying HXQ & ZNQ (virtually the same but I decided to buy both anyways) until this year when I started buying VEQT as well. Since my focus is on TFSA this year, I will continue with what I have been doing for now.